Property Taxes

Property taxes play an essential role in financing the operations of the City of Mercer Island, accounting for approximately 37% of the General Fund’s total budgeted revenues. Property taxes help fund the following:

- 24/7 police services

- 24/7 fire suppression services

- 24/7 emergency medical aid services

- Park, path, trail, and public building maintenance

- Street, roadside, and median maintenance

- Recreation program support for youth and seniors

- Community planning, development code regulations, and code enforcement

- Televised Council meetings, public communications, and records management

- Fire apparatus replacement

Property tax is the largest revenue source for the City of Mercer Island. This revenue supports critical city services, including police officers, firefighters, streets, sidewalks, and parks.

Types of Property Tax

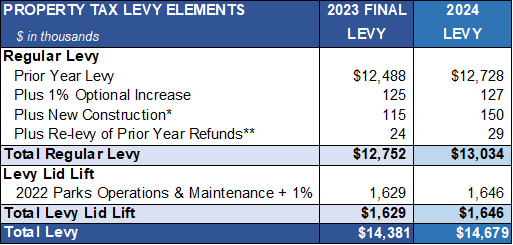

There are two types of property taxes collected by the City: 1) regular levy, and 2) voter approved levy. The regular levy, which is $13.03 million in 2024, represents the base amount of property tax dedicated to funding the City’s general government operations, which are noted above.

There are two types of voter-approved levies, which represent property tax increases over and above the regular levy: 1) excess levy, and 2) levy lid lift. An excess levy is dedicated to paying the principal and interest on debt issued for capital projects or purchases. Currently, the City does not have any excess levies.

A levy lid lift is dedicated to funding specific general government operations and/or capital improvements. The City has one levy lid lift currently in effect: Parks Maintenance and Operations levy approved by voters in November 2022 for 16 years ($1.65 million levy amount in 2024).

Each November, the City Council sets the property tax levy for the coming year based on forecasted expenditures, other revenue sources, and state law limitations. The regular levy is annually limited to a 1% increase or the rate of inflation as measured by the Implicit Price Deflator (IPD), whichever is less.

The IPD is not the same as the Consumer Price Index for Urban Wage and Clerical Workers (CPI-W), to which annual cost of living adjustments for City employees are tied. The City’s levy lid lift is also limited to a 1% annual increase.

Cities are also provided an allowance for new construction, which entitles the City to the property tax revenue generated by newly constructed and improved residential and commercial properties that is determined by the King County Assessor’s Office.

2024 Levy

A breakdown of the City's 2024 levy relative to 2023 is provided below:

** The refund levy represents the amount that was refunded to property owners who successfully appealed their property valuations by the King County Assessor’s Office. To make the City whole, the amount of those refunds is re-levied in the following year.

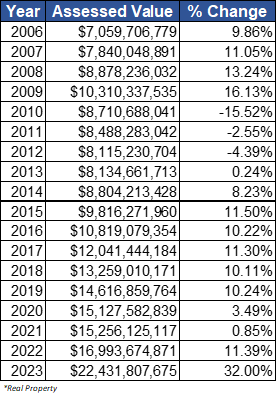

Assessed Valuation

For the tax years 2006-2023, the total assessed value of Mercer Island and the percentage change relative to the prior year is summarized below.

Questions?

If you have questions about your property taxes, contact the King County Assessor's Office.

E-mail Address: Assessor.Info@KingCounty.Gov

Phone: 206-296-7300

TTY: Relay 711 or 800-833-4388

Fax: 206-296-0107