Financial Challenges - Additional Property Tax Information

Other information that is pertinent to the City’s financial challenges includes:

- Mercer Island’s rural character and small commercial footprint;

- The 2018 property tax levy; and

- The City’s 2018 property tax levy rate.

There is a financial consequence associated with Mercer Island’s rural character and small commercial footprint. Unlike Bellevue, Kirkland, Redmond, and Issaquah, which all have significant retail sales tax bases, Mercer Island is heavily reliant on property tax, which accounts for 41% of its General Fund revenues, versus 20%, on average, for these Eastside cities.

- The upside is that Mercer Island does not have the traffic congestion and crime that accompany cities with large commercial sectors.

- The downside, given the 1% annual growth limitation on property tax, is that an unrealistic burden for annual growth is placed on the City’s other revenue sources (i.e., sales tax, utility taxes, license & permit fees, and park & recreation fees).

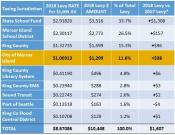

For the 2018 tax year, the total property tax levy for a $1.20 million home, which is the median assessed value (AV) on Mercer Island, is $10,448, which is broken down by taxing jurisdiction in the table below.

*2017 levy amount is based on a $1.09 million home, which was the median AV for the 2017 tax year.

Note that 60.2% of the total property tax levy in 2018 goes to education (State School Fund and Mercer Island School District), while only 11.6% goes to the City of Mercer Island.

Comparing 2018 to 2017, the total property tax levy increased $1,607, or 18.2%, mostly due to the following:

- $1,308, or 59.2%, increase in the State School Fund levy (a result of the state legislature’s “McCleary fix”);

- $157, or 6.0%, increase in the Mercer Island School District levy; and

- $96, or 6.4%, increase in the King County levy primarily due to the Veterans and Human Services levy, which was approved by voters in November 2017.

The City’s 2018 property tax levy increased only 1% for existing property owners, with an additional 1.4% generated from new construction, remodels, and additions on the Island.

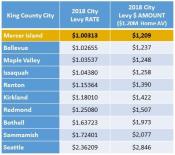

Looking at 2018 city levy rates, Mercer Island has the lowest levy rate among King County cities with a population of 20,000 or more. So, what does that mean? A Mercer Island homeowner will pay less property tax to the City than a homeowner in another King County city will pay to his/her city, assuming homes with the same assessed value.

See the sample listing of 10 King County cities below showing each city’s 2018 levy rate per $1,000 AV and the amount of property tax paid to each city based on a $1.20 million home assessed value.